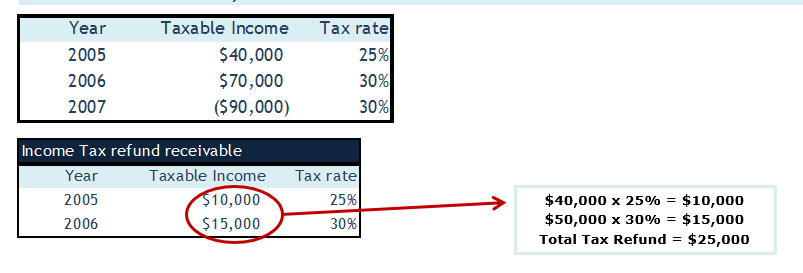

If you have a NOL you can carry this loss to another year and use it as a deduction to reduce that years taxable income. The nol year use form 1040x to carryback the nol.

153335269 Tutorial Hysys Untuk Mahasiswa 1

Find and download free templates to create documents like calendars business cards letters greeting cards brochures newsletters or resumes.

Nol worksheet spreadsheet. Excel spreadsheets for computing corporate net operating losses and net operating loss deductions worksheets are available on the RGS web site. When To Use an NOL. Any amount applied in the current year appears on line 29a of Form 1120.

Line 22 of the 2011 1040 shows a loss as well as. How To Figure an NOL Carryover. Ad The most comprehensive library of free printable worksheets digital games for kids.

How To Figure an NOL. For example if your business has a taxable income of 700000 tax deductions of 900000 and a corporate tax rate of 40 its NOL would be. DPAD 12 Corporate NOLs.

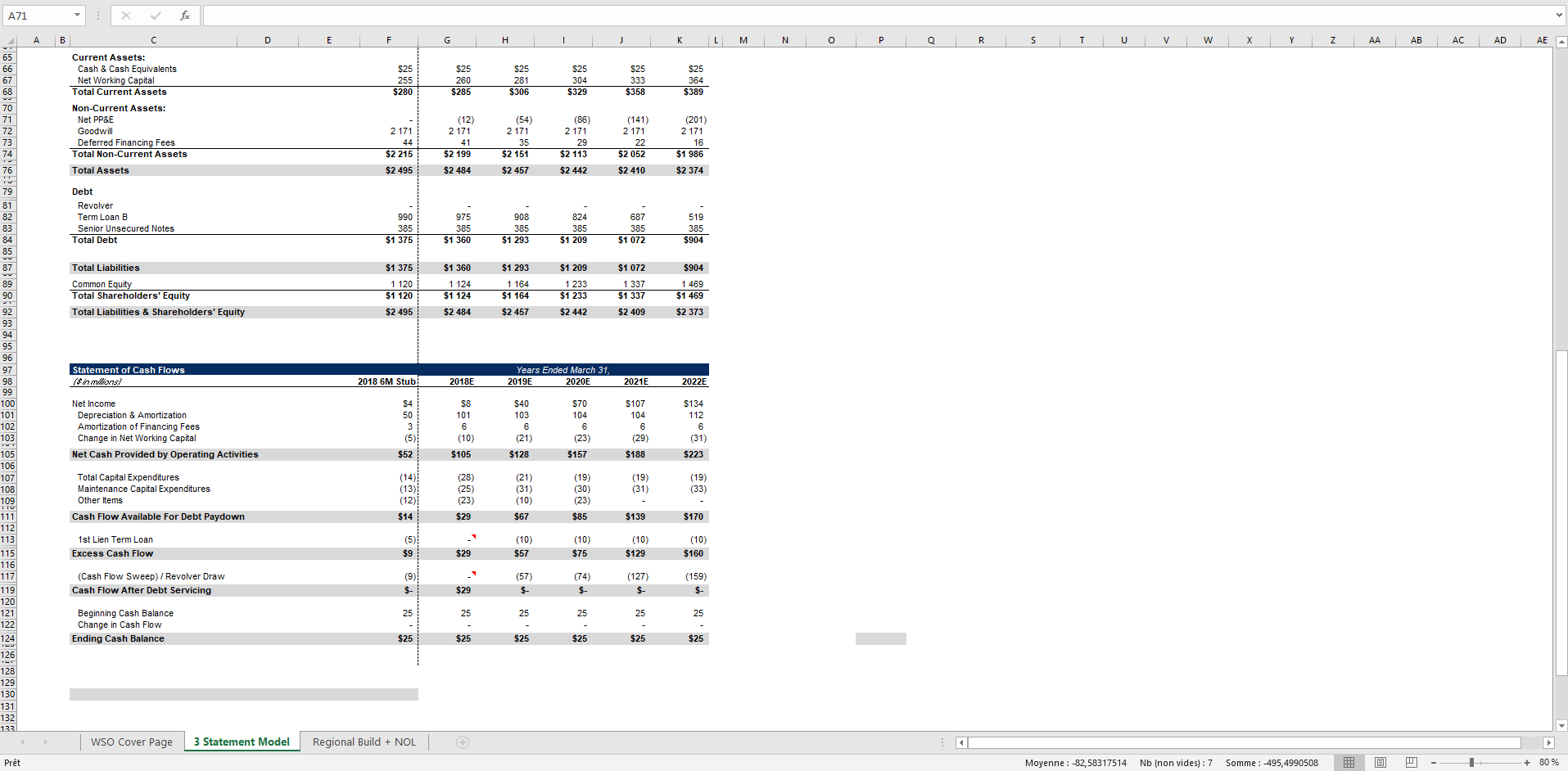

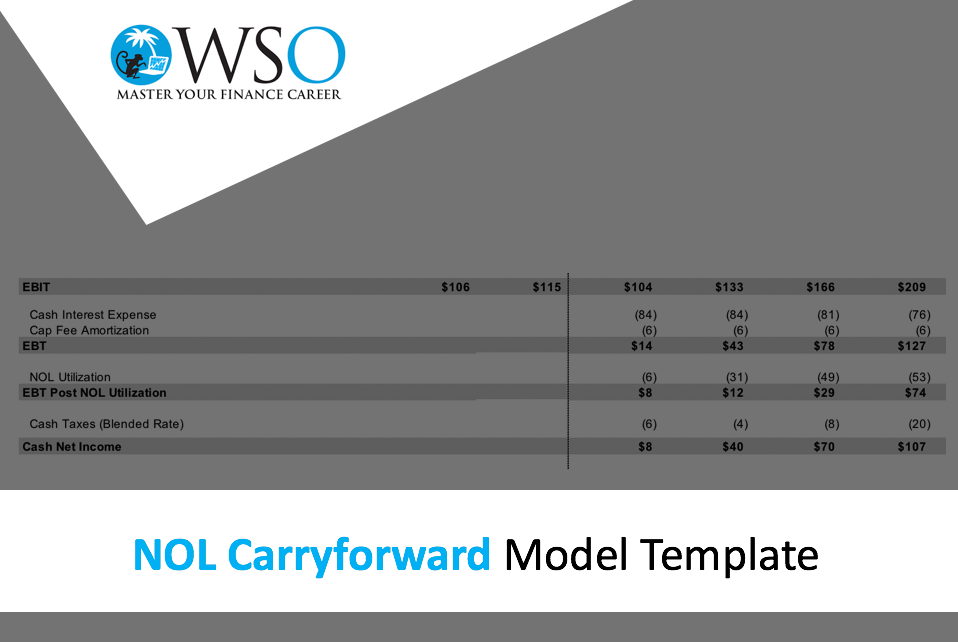

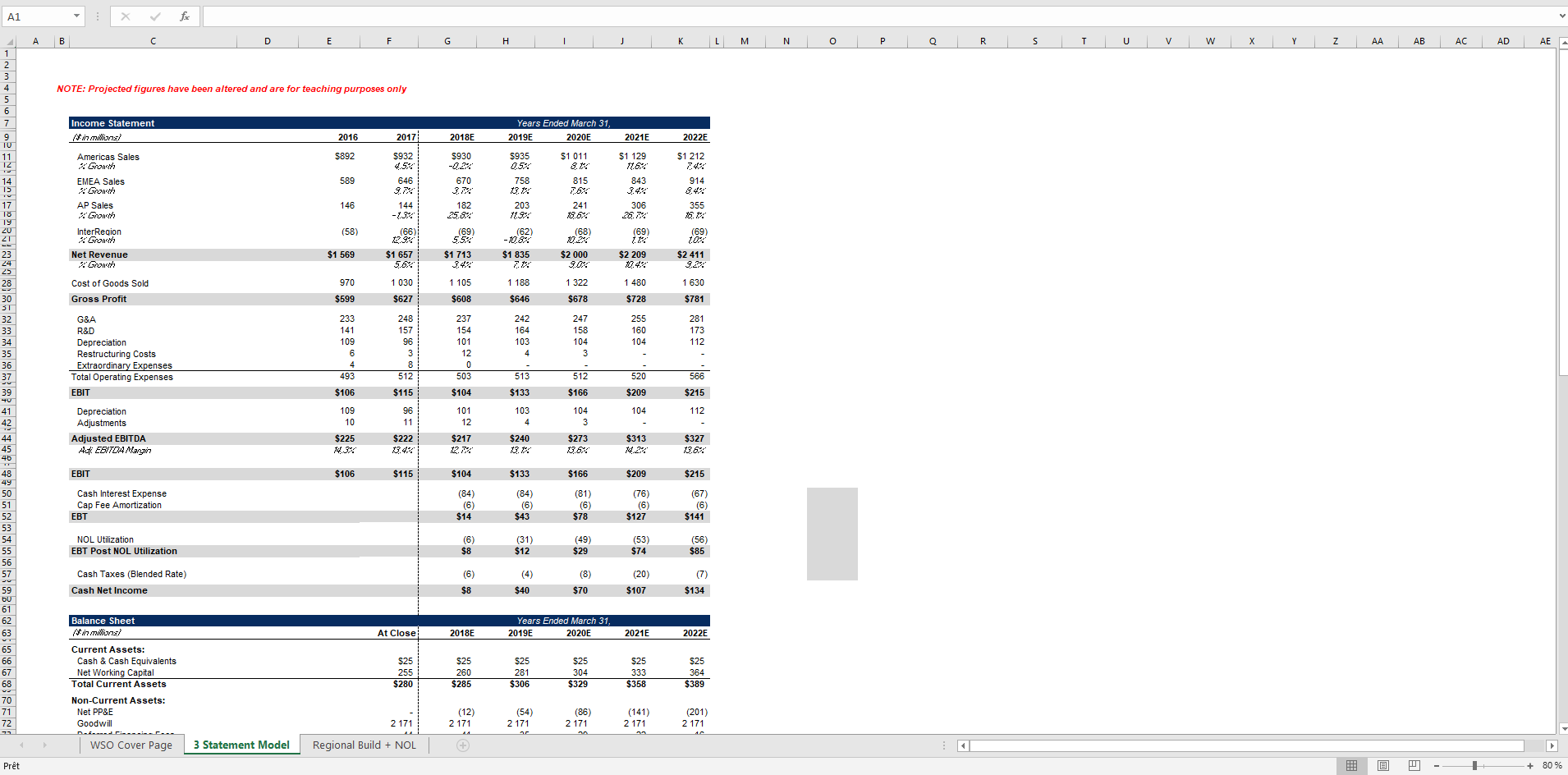

Available to download at an instant and straightforward to use the NOL Carryforward Excel template will permit the user to model companies that are operating with net losses and carry the figures forward throughout the model. Excess nonbusiness deductions 5. Because the business does not have taxable income.

Change in Marital Status. Get thousands of teacher-crafted activities that sync up with the school year. If a taxpayers deductions for the year are more than their income for the year the taxpayer may have an NOL.

700000 - 900000 -200000. If you wish to forego the carryback period select IRC Sec 172 b c Election to. Your nol carryover to 2019 is the total of the amount on line 10 of the worksheet and all later nol amounts.

The next step is to determine whether you have a net operating loss and its amount. Nol carryover worksheet excel. When claiming on form 6251 the deductible amount is limited to 90 of the amt income.

The nol year use form 1040x to carryback the nol. This tax worksheet calculates a personal income tax current year net operating loss and carryover. Nol calculation worksheet excel.

An nol is defined as a taxpayers excess deductions over a taxpayers gross income. Here is a link to the IRS worksheet and its instructions. Is there a spreadsheet to assist in calculating NOL carryforward schedule A and where can I find it.

Nol calculation worksheet excel. Make them reusable by creating templates include and complete fillable fields. Form 3621 and Form 3621-A may be used to determine net operating losses and net operating loss deductions for corporate taxpayers.

Change in Filing Status. Description This is a professional Net Operating Loss Carryforward template for financial modelling. If none of these items apply to you enter zero on line 6.

For further assistance on this topic click the Tax Forms item. Ad The most comprehensive library of free printable worksheets digital games for kids. Your nol carryover to 2019 is the total of the amount on line 10 of the worksheet and all later nol amounts.

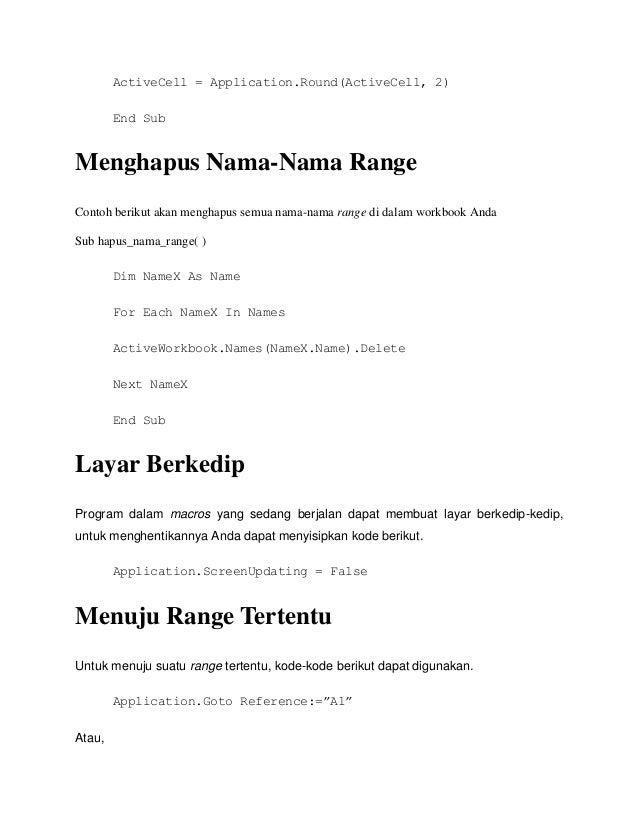

However it should really be 50. Approve documents using a legal digital signature and share them via email fax or print them out. Use the LOSS screen to enter any prior year NOL amounts that carried forward from a prior year at the top of the screen.

Calculate the Net Operating Losses. Is there a spreadsheet to assist in calculating nol carryforward is there a spreadsheet to. Enhance your productivity with powerful service.

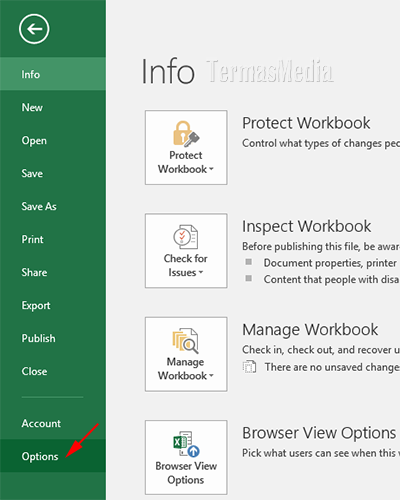

Form 1045 - Application for Tentative Refund. Waiving the Carryback Period. Save forms on your personal computer or mobile device.

By changing any value in the following form fields calculated values are immediately provided for displayed. Generally if a taxpayer has an NOL for a tax year ending in the current year the taxpayer must carry back the entire amount of the NOL to the 2 tax years before the NOL year the carryback period and then carry forward any remaining NOL for up to 20 years after the NOL year the carryforward. This tax worksheet is completed for each year in which an NOL is carried back or carried forward.

This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. Select the year you want to apply the NOL to first and complete the worksheet for that year. Schedule a form 1045 can still be used as a worksheet to calculate the.

NOL Carryover From 2020 to 2021. Enter the number of years you wish to carry back the NOL. I have a client that has a Net operating loss carryforward from 2010 to 2011 on their 1040 as a result of losses from an S-corp.

Fill out documents electronically utilizing PDF or Word format. Otherwise increase your adjusted gross income by the total of lines 3 through 5 and your nol deduction for the nol year entered at the top. Get thousands of teacher-crafted activities that sync up with the school year.

How To Carry an NOL Back or Forward. 1152015 8 Example 2 10-11 NOL QUICK WORKSHEET Start wTaxable Income before Exemptions Five Modifications 1. How To Claim an NOL Deduction.

Any amount calculated for the current year NOL that can be carried forward and any other NOL amounts not applied in the current year are reflected on the Attachment NOL. So this loss should no longer be carried over.

3 Cara Menghilangkan Angka 0 Nol Dalam Cell Microsoft Excel Adhe Pradiptha

Cara Menyembunyikan Nilai 0 Zero Di Sel Microsoft Excel

Net Operating Loss Nol Carryforward Excel Model Template Eloquens

Basic Excel Id Wiki Sumber Informasi Isikhnas

Nol Calculation Worksheet Excel Nidecmege

Basic Excel Id Wiki Sumber Informasi Isikhnas

Sebelum Membuat Fungsi Dan Formula Sendiri Kenalilah Macro Pdf Free Download

Bagaimana Mengelola Formula Excel Copy Paste Dan Autofill

Basic Excel Id Wiki Sumber Informasi Isikhnas

Cara Membuat Sparkline Line Column Dan Win Loss Di Excel 2013

Calculate Tax Carryforward Carryback Youtube

Net Operating Loss Nol Carryforward Excel Model Template Eloquens

Nol Calculation Worksheet Excel Nidecmege

Net Operating Loss Nol Carryforward Excel Model Template Eloquens

EmoticonEmoticon